…indicates a recovering economy

Thukten Zangpo

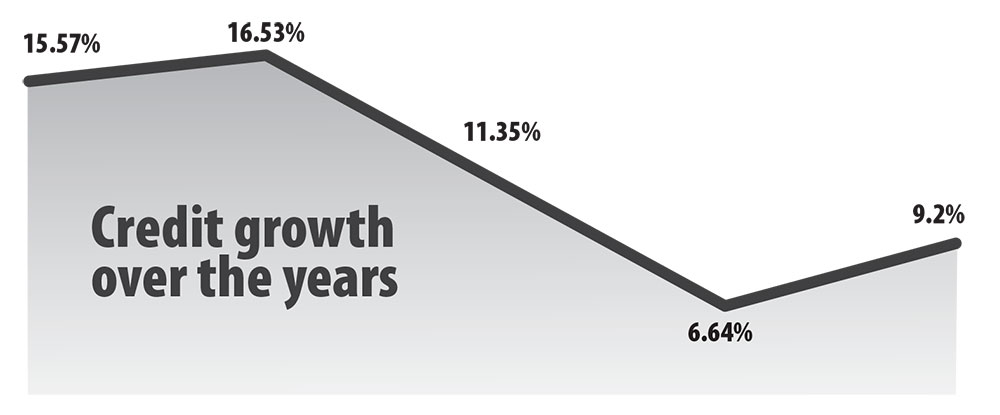

With the re-opening of the economy, the total credit growth of financial institutions (FIs) saw an increase by 9.2 percent as of September this year from the same month last year, the Royal Monetary Authority figures show.

The total loan disbursement from FIs to customers amounted to Nu 191.96 billion (B) as of September this year. It saw an increase of Nu 16.17B from September last year.

The credit growth had recovered after it slumped to 6.64 percent in September last year. It was the lowest recorded since the rupee shortage in 2012.

This was triggered by the pandemic that led to a weakening of economic activities, risk aversion behaviour of FIs, and delay in government spending on capital projects.

However, for the credit growth to reach the pre-pandemic level, it should be above 15 percent.

Credit growth is good for an economy because FI’s credit growth signals an economic recovery.

More credit means consumers can borrow and spend more for housing, education, consumer durables, vehicles and other personal expenses. And enterprises can borrow and invest more.

The finance ministry projected an economic growth rate of 4.95 percent this year after recording a growth rate of 4.09 percent in 2021. The economic growth dipped to -10.01 percent in 2020 because of the pandemic.

Breaking into the economic sectors, loans disbursed to the housing sector, which accounted for 27 percent of the total loan, were recorded at Nu 51.83B. It is an increase of Nu 6.3B.

The service and tourism credit at Nu 55.6B, which was severely impacted by the pandemic, saw a growth of about 12 percent. This sector accounted for 28 percent of the total loans.

There has also been growth in education loans by over 50 percent to Nu 10.25B from Nu 6.76B.

Credit to the transport sector increased by 43.23 percent to Nu 9.98B because of the demand for passenger cars.

To save the country’s dwindling foreign currency reserves, the government suspended the import of select vehicles from August this year. This could save the government about Nu 5B annually.

However, credit to trade and commerce was contracted by Nu 3.74B to Nu 16.39B. The loans to the production and manufacturing sector declined to Nu 20.66B, a decrease of Nu 1.41B.

Similarly, agriculture credit saw a decrease at Nu 5.61B from Nu 6.65B.

An economist said that more than 60 percent of the sectoral loans comprise import and consumption loans, which are not much help for economic growth.

Being an import-dependent country, more flow of money in the economy would result in further widening the country’s trade deficit.

The country’s trade deficit, including electricity, has been widening over the years. At Nu 48.14B, the trade deficit as of September this year was more than the value of export of Nu 44.9B. It saw an increase of Nu 15.9B from the previous year.

This could pose a threat to already dwindling foreign currency reserves. The total foreign currency reserves have decreased by over 40 percent to USD 729.7 million (M) as of September this year from USD 1.29B in the same month last year.

Bhutan’s total reserves can only meet 13.11 months of essential imports, more than a month’s reserve mandated by the Constitution of 12 months.